- Chart

- Brokers

- Markets

- Cryptocurrencies

- Crypto Screener

- Prices

- Market Cap charts

- Bitcoin

- XRP

- Ethereum

- Bitcoin Cash

- EOS

- Stellar

- Litecoin

- Bitcoin SV

- Tether

Crypto Market Cap, BTC/USD, ETH/USD, USDT/USD, XRP/USD, Bitcoin

- Currencies

- Stocks

- Earnings Calendar

- Stock Screener

- Large-cap

- Top gainers

- Top losers

- Most active

- Most volatile

- Overbought

- Oversold

- All-time high

- All-time low

- High-dividend

- Sector & Industry

Apple, Advanced Micro Devices Inc, Amazon Com Inc, TESLA INC, NETFLIX INC, Facebook Inc

- Indices

S&P 500, Nasdaq 100, Dow 30, Russell 2000, U.S. Dollar Index, Bitcoin Index

- Futures

- Bonds

US 10Y, Euro Bund, Germany 10Y, Japan 10Y Yield, UK 10Y, India 10Y

- Cryptocurrencies

- Screeners

- Ideas

- Streams

- Scripts

- Editors' picks

- Oscillators

- Centered oscillators

- Volatility

- Trend analysis

- Volume

- Moving average

- Exponential Moving Average (EMA)

- Weighted Moving Average (WMA)

- Simple Moving Average (SMA)

- Hull Moving Average (HMA)

- Kaufman's Adaptive Moving Average (KAMA)

- Smoothed Moving Average (SMMA)

- Variable Index Dynamic Average (VIDYA)

- Volume-weighted Moving Average (VWMA)

- Fractal Adaptive Moving Average (FRAMA)

- Double Exponential Moving Average (DEMA)

- Breadth indicators

- Bill Williams indicators

- More

Hello traders and investors! Let’s talk about AAPL today! First, it hit the bottom level of the Descending Channel we talked about in my last analysis. The sentiment is still bearish, and it lost the red line at $ 120.45 as well. But there’s a light at the end of the tunnel. Right now, AAPL is reacting very well, and if it closes above the red line, the...

![[AAPL] APPLE BUY SETUP AAPL: [AAPL] APPLE BUY SETUP](https://s3.tradingview.com/f/fLFeMnAn_mid.png)

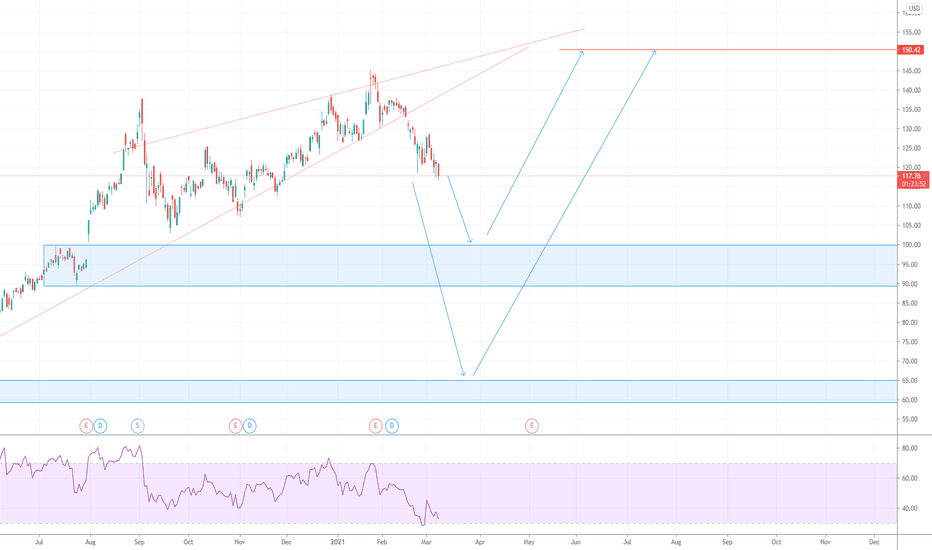

looking for another ATH near 150$ , if equity market rebounds. Stop level : 105$ or lower daily close.

What if instead of a crash like a year ago, we just completed a complex corrective pattern in a bull market? Rare to see bullish divergence on a name like this $QQQ $NDX $NQ_F $MSFT $AMZN $GOOG $FB $SPY $ES_F $VIX $TNX #Trading #ElliotWave #Stocks

So as you can see in the Andrews pitchfork for Apple's price action during the current bull run, we are concerned about this break down at the schiff line extension. Traditionally when asset price action falls below this line there is a buying opportunity. But there is also a concern that the trend has now turned bearish and will continue to break down. We are...

Everytime we refer on Elliott Waves theory in our ideas. So let's have a short explanation about what this is today. Elliott Wave Theory is named after Ralph Nelson Elliott (28 July 1871 – 15 January 1948). He was an American accountant and author. Inspired by the Dow Theory and by observations found throughout nature, Elliott concluded that the movement of the...

Buy entry @ 116 Take Profit @ 136 Stop loss @ 106 Good luck

Took 3/4 off AAPL shrt 135 to 118 12.59 % PROFIT Staying short 1/4. It is time buy soon stoch getting close to bottom and we should bounce off 200 day so I may get out short their watch weekly 200 day hold but but it will make lower high guy and totally collapse will let u know totally when out shorts and gone long Still a shrt

Showing high call volume for Apple in the neighborhood of 138m today since we just hit the .3 retrace. This will be the first recoil from the first part of the correction. There will be another dip in April and May; I would suggest exiting one we reach about 70% or 80% of the ATH, but that is up to you. Either way, a lot of opportunity to make some money on...

AAPL has been included in the tech sell off. Is this enough or will AAPL be included in the bear market in the coming weeks? I personally feel this is a good price considering it was 145 only a few weeks ago but it also had a great rally like many tech stocks in 2020. But Apple is one of the few tech stocks that actually has fundamentals and a solid future....

Greetings All, AAPL is bearish in the short-term (technical correction) based on price falling below the 20, 50, and 100MA. AAPL is currently at a very strong level of support at $116, and could decide to retrace upward from here. However, AAPL is approaching the 200MA (yellow line) which is also the S2 level around $113. The red trend-line is acting as...

Sitting at the average price since the pandemic low right here...I think APPL decides where we go from here

AAPL daily chart Apparently, the answer to my question on my previous post is a "no" and AAPL hasn't seen the bottom point yet at $117.45 and went down even further today. Because why not? We're just drawing ideas and trying to guess. Only the big money knows where it will go. However, fibonacci levels (of April 2020) and formations (seen at daily shorter time...

Well we've hopefully seen the end of apple and now it's time to bull apple. LETS GO BULLISH!

Live Challenging Market Analysis Buy APPLE STOCK @ 100 Target @ 150 Entry 2 @ 65 Target Buy 1 & 2 @ 150 Our Unique Features: ————————————————————— 1. Follow our 15 signals ….10% equity will increase in your account for sure. 2. We are not Trailing stop! or average the trades. 3. 2% Risk Management Per trade. 4. Risk vs Reward up to 1:7. Note: Trade signals...